Your Money, Your Future: 7 Ways to Use Your Financial Planning Benefits

Financial wellness is your ability to balance bills, plan spending, manage money, and feel financially secure. Many of us have stressors relating to income, bills, and saving. If worries about money are affecting you, we offer many tools to help you deal with financial issues and plan better.

Your Benefits At Genesco offer a wide array of financial planning benefits to help you achieve your goals and secure your future. Discover a few of those benefits below, and learn ways you can utilize them to help you set and achieve your own personal financial goals!

1. The Currency

The Currency, a blog curated by Empower, serves as your gateway to a treasure trove of financial wisdom. This blog is your go-to source for tips on budgeting, retirement planning, investing, tax strategies, and much more. Whether you’re a financial novice or a seasoned pro, The Currency provides valuable insights and actionable advice that can help you make informed financial decisions.

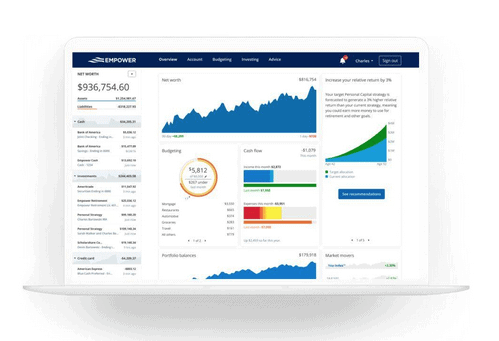

2. Empower’s Financial Dashboard

Empower’s financial dashboard is a game-changer for managing your finances effectively. Here’s what it offers:

Link All Financial Accounts

Empower’s platform allows you to link all your financial accounts seamlessly. From credit cards to retirement accounts, bank accounts to loans, and investments to mortgages, you can see your assets and debts in one consolidated view. This approach gives you a holistic view of your financial picture.

Track Your Net Worth

Knowing your net worth is crucial for assessing your financial health. Empower’s tools make it easy to track your net worth over time, helping you set and achieve your financial goals.

Monitor Retirement Progress

Planning for retirement is a top priority for many of us. With Empower’s tools, you can closely monitor your retirement progress. These insights empower you to make necessary adjustments to your savings and investment strategies as you work towards a secure retirement.

Visit empowermyretirement.com for more information.

3. Consultations with Financial Professionals

Are you nearing retirement, or do you have complex financial questions?

Empower offers you the opportunity to schedule an appointment with a financial professional to discuss your goals and objectives. This is a great resource for those nearing retirement or looking to improve their retirement game plan.

Carelon also offers a free 60-minute phone consultation with a financial expert who can provide guidance on taxes, budgeting, estate planning, and more.

Not sure where to start? Here are a few topics these financial advisors can help you with:

- Building an Emergency Fund

- Creating a Budget

- Tackling Debt Paydown

- Retirement Planning, and more!

Visit empowermyretirement.com for more information.

4. Identity Theft Resolution

Carelon offers a lifeline in the face of identity theft concerns. With a simple 30-minute phone call, you can access our expert identity theft resolution services. Our dedicated professionals will guide you through the steps to navigate and resolve identity theft issues, providing you with peace of mind and the support you need during this challenging time. Your financial security is our priority, and Carelon is here to assist you every step of the way. Visit www.carelonwellbeing.com/genesco.com for more information.

Allstate Identity Protection is also offered to employees to help minimize risk, damage, and stress with prevention and rapid restoration. Allstate offers several key features such as dark web monitoring, financial transaction monitoring, high-risk transaction monitoring, credit monitoring and alerts, credit assistance, and social medical account takeover monitoring.

5. Will & Estate Planning

Will and estate planning is invaluable as it enables individuals to dictate how their assets are distributed, minimizing tax burdens, providing for their loved ones, preventing disputes, and offering peace of mind by ensuring your wishes are respected and financial affairs are in order both during your lifetime and after you’ve passed. Ensure your legacy is protected by utilizing the free will and estate planning services provided by MetLife. Click here for more information regarding the available prep services.

6. Financial Education Webinars

MetLife also provides access to some excellent financial education seminars via their PlanSmart and Retirewise series.

- PlanSmart Financial Education: Access pre-recorded workshops that cover a wide range of financial topics, helping you make informed decisions.

- Retirewise Education Series: Prepare for retirement with confidence through the Retirewise education series, equipping you with the knowledge and strategies to enjoy a comfortable retirement.

Be on the lookout for more information

7. The MetLife Personal Finance Mobile App

The MetLife Personal Finance mobile app is your key to achieving financial success in many impactful ways:

- Reduce bills with expert bill negotiation services*

- Get a handle on student debt

- Cancel unwanted subscriptions

- Set-up an emergency fund, and

- Get a free credit report

Learn more by visiting the App Store and Google Play.

8. Check with your banks and credit card companies

If you currently have a bank account or a credit card, make sure you check on the benefits offered. Almost all banking institutions now offer credit counseling, free credit reports, and other financial services to all customers.